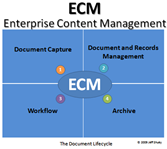

What is the “Mystical Triangle” and what does it mean for the ECM market, the new entrants to the field, partners, and customers.

There is nothing all that mystical about it --- the top of the pyramid is where the Enterprise customers reside and it’s where the Enterprise Content Management (ECM) vendors have focused their efforts.

The Big Three ECM vendors (FileNet, Documentum, and Open Text) and the big capture vendors have focused and lived at the top of the MT (Mystical Triangle) for years. That is as expected. That was the right place to focus many reasons – not the least of which is the somewhat generic need across all enterprise accounts for ECM solutions. This is not to say that every enterprise account is the same, but there are a lot of similarities in their need for enterprise content management which made it easier for the Big Three ECM vendors to tailor their their solutions to capture a broad swath of the market.

What’s Changing?

A change is coming because the enterprise market is saturated. The ECM vendors need to move down the pyramid (aka The Mystical Triangle) to capture customers in the lower sections. The lower sections include more customers – which is a boon and a bane. The boon is that there is a greater customer count, but not necessarily more revenue. The bane is that the customers in the lower sections are much more diverse and harder to serve with a one size fits all mentality that the enterprise vendors have gotten used to delivering.

In order to serve these customers there is a growing need for new and more diverse product offerings. The next generation of ECM solutions will be Rich Internet Applications (RIA's) and will be bubbling up through a group of up and coming software vendors. Sure, the traditional ECM vendors will have a play in this area, but I think they will rely upon acquisitions to get there quickly.

What does it mean for The ECM industry?

All goodness. Acquisitions by the platform vendors and by the ECM vendors. Partners that create vertical solutions will probably be first. Horizontals will not be left out. Both types of vendors will require integration efforts that will take time from engineering / development, marketing, and sales, and executives to craft the overall message and to create solutions that help address the needs of the mid-market and small-medium business segments.

I hope the big winners in the end are customers.

Risk Management

Why will smaller vendors sell to the larger vendors? Sometimes the economics just make sense. Sometimes customers or partners call out the risk of going with a small vendor – wondering if they will be able to meet their needs long term. Of course there are benefits too - nimble, customized, responsive, etc. and these are the reasons why the big players seek them out.

What brings the smaller vendors to the attention of the big players? Again, it’s customers and partners. Customers and partners will say "What about vendor X?" And when this happens often enough the big ECM vendors are forced to sit up and take notice.

| Case in Point | |

| Who remembers Watermark? | |

| Watermark was an ISV started by a friend and mentor - David Skok. Watermark caused so much pain for FileNet that FileNet eventually ended up buying them. There are at least three ways to spin this story, but they key point is that customers won. I predict similar things will happen again in the ECM space. Note: FileNet was acquired by IBM in 2006 for $1.6B |

Predictions

- ECM vendors will open their checkbooks

- The ECM market will continue to consolidate

- The Mystical Triangle and the Magic Quadrant will have far fewer ECM vendors to stack rank (and extract cash from).

- Section 3 - BPM / Workflow is still too fragmented with 150+ players

- Section 4 - Archive is the opposite with just a few players.

- However, in the archive space new entrants are making headway - primarily by leveraging cloud based services.

Who will be next?

It's just a matter of time. I think 2009 will see a few contractions and 2010 will see acquisitions, contractions, and mergers.

Below are my predictions. What are yours?

Note: Open Text is the only remaining Big 3 ECM vendor.

IBM already bought FileNet and EMC bought Documentum.

How you can play?

Post a comment to this blog. Select the vendor and the quarter you think they will acquired, merged or contracted (or otherwise change their operational status). Multiple guesses are allowed and encouraged. There will be a lot of changes coming. Place your bets today! I’ll figure out what the prizes are later. Thanks for playing!

Thinking Points:

- What are your Predictions for the ECM Market?

- Do you see RIA’s driving the next generation of ECM solutions?

- What are the best ECM RIA’s you’ve seen?

| About The Author: I have spent the better part of the last 16 years working in various aspects of the ECM space. I spent time at Kofax, Microsoft, FileNet, K2, and most recently Captaris (which was acquired by Open Text in Nov 2008). Prior to that I was a Unix VAR running my own company. Follow me on Twitter, check my blog, send email or find me on Facebook or LinkedIn. |

This work is licensed under a Creative Commons Attribution 3.0 United States License.

Comments

I don't think many will argue with you that there will be more consolidation in the ECM space. I could be wrong, but I doubt Microsoft will make a substantial acquisition there just yet.

I do think you're jumping the gun a bit on cloud computing. It's going to continue to experience gradual but slow acceptance in the marketplace, especially in the enterprise taking at least 5 years for it to gain enterprise adoption (not 1.5 years). With that said, Amazon, Microsoft, and Google are in it for the long haul. It will be really interesting -when- Google makes a play in the 'cloud' ECM space after it acquires Salesforce.com. That would accelerate cloud adoption in the enterprise!

CMIS – Seeing increasing adoption of this draft standard which, longer term, will provide vendor independent ECM applications to be delivered against Content Application Servers

Open Source – As companies start to address the mid-market and SMB’s they will need to change their cost models. Open Source vendors are perhaps better placed to address this market than traditional ECM vendors [Disclaimer: I work for Alfresco]

Thanks

Customer Communication Management